Back

Case studies should be viewed in bigger screens for now

Back

Case studies should be viewed in bigger screens for now

Back

Case studies should be viewed in bigger screens for now

Back

TBC Bank: Solving physical problems with digital solutions

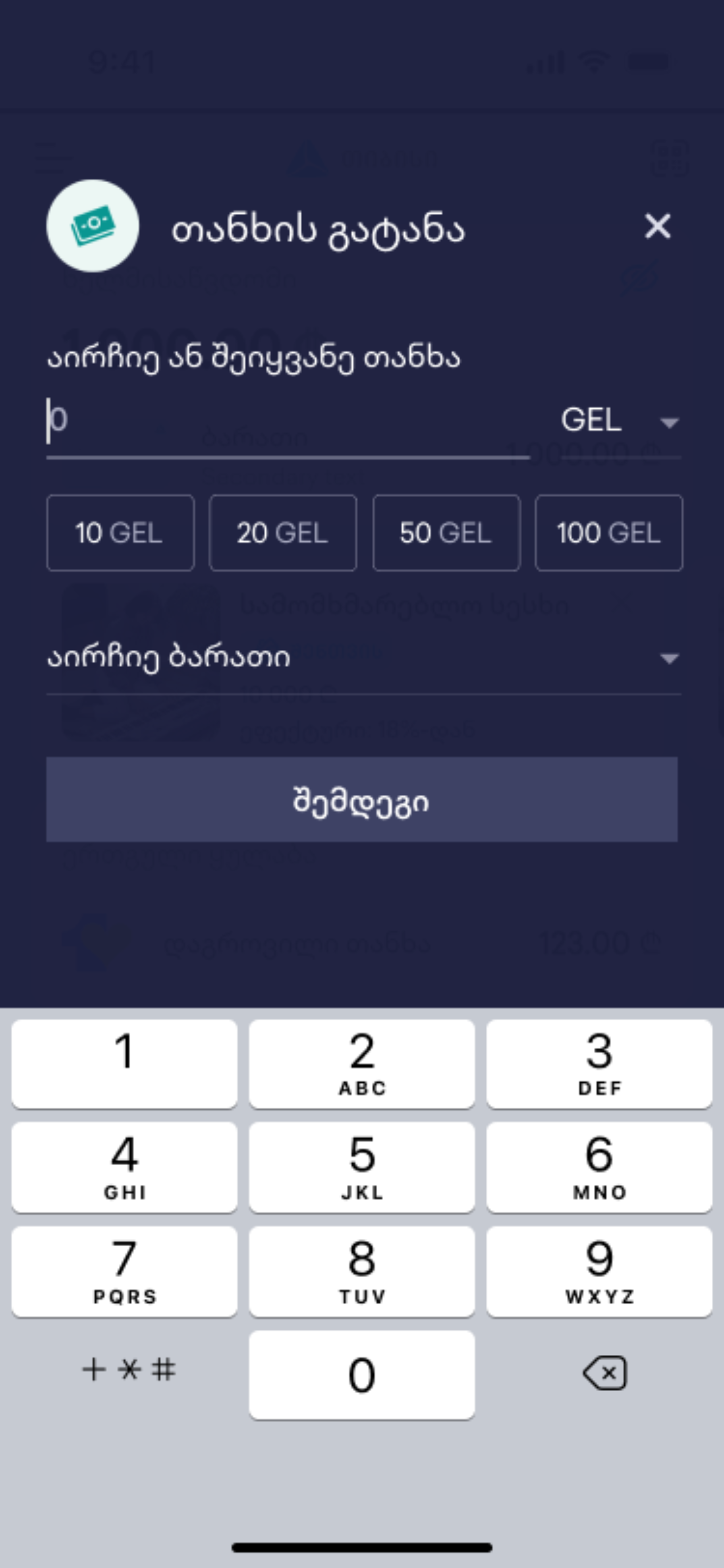

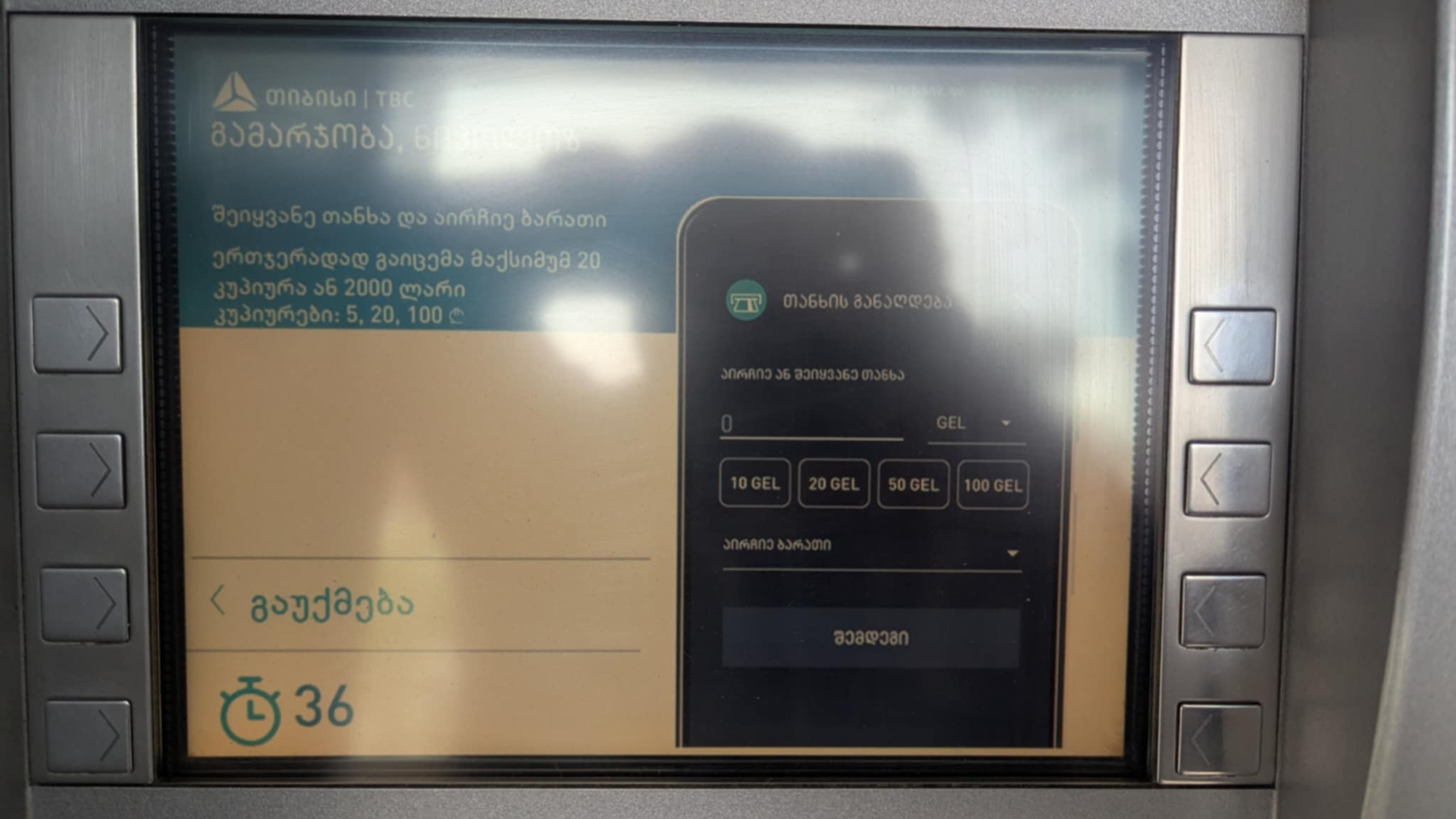

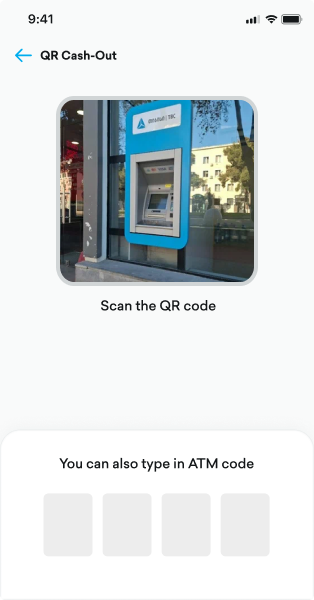

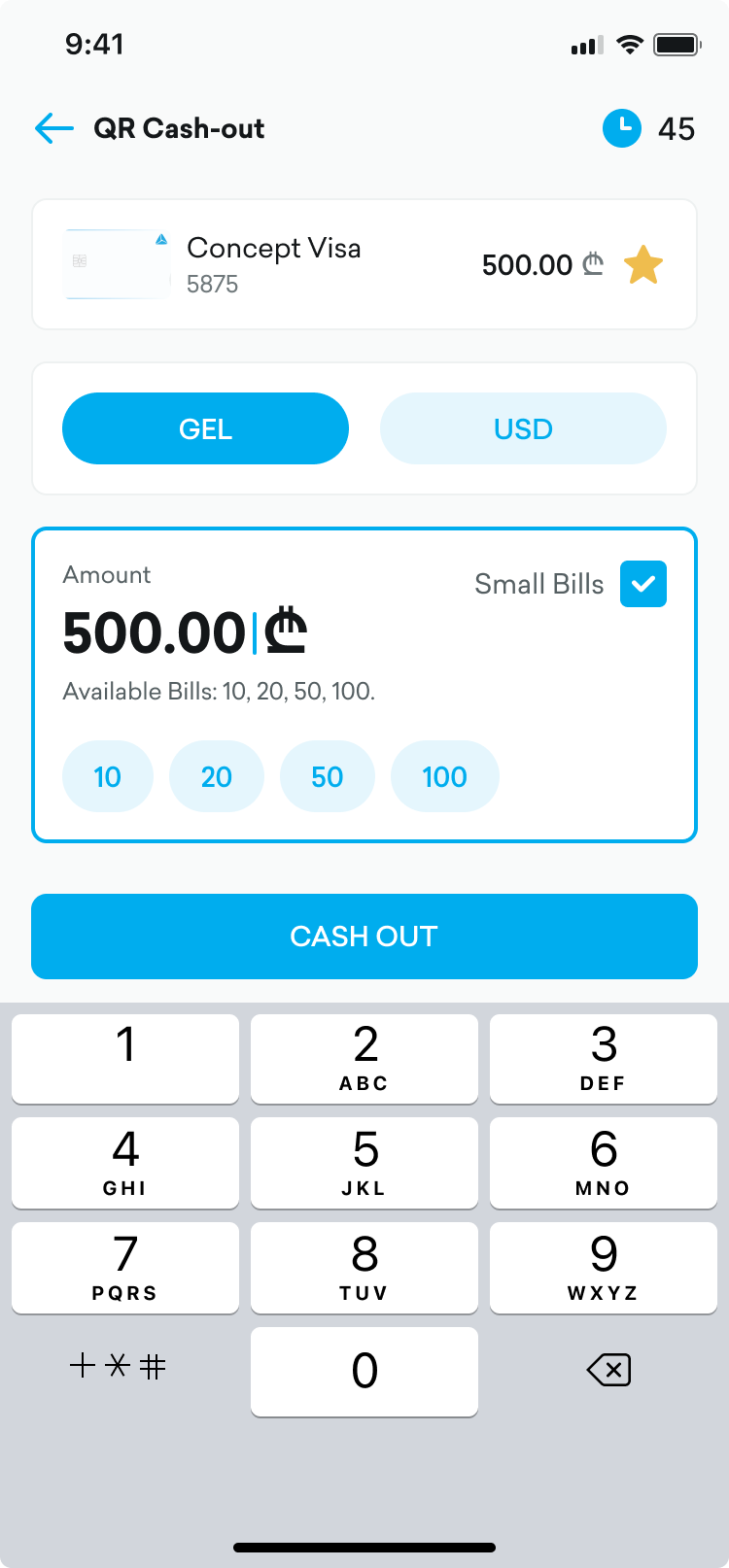

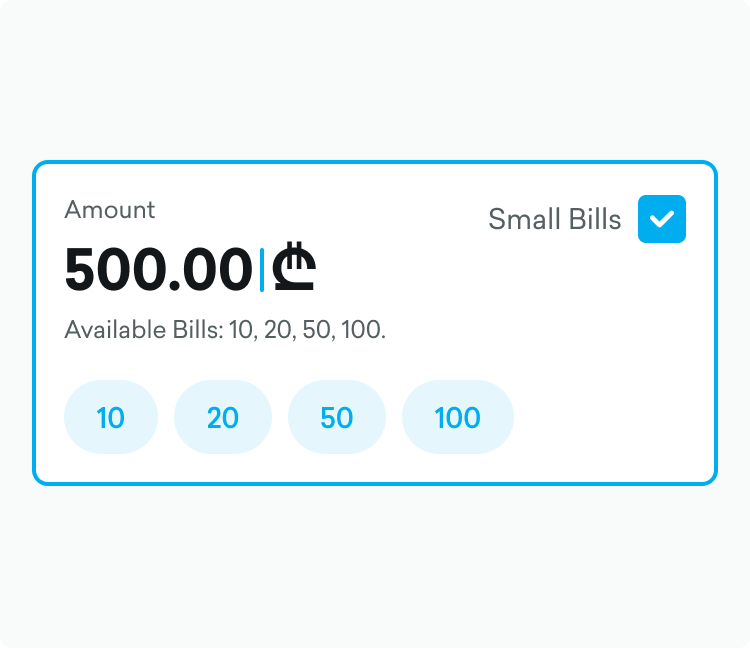

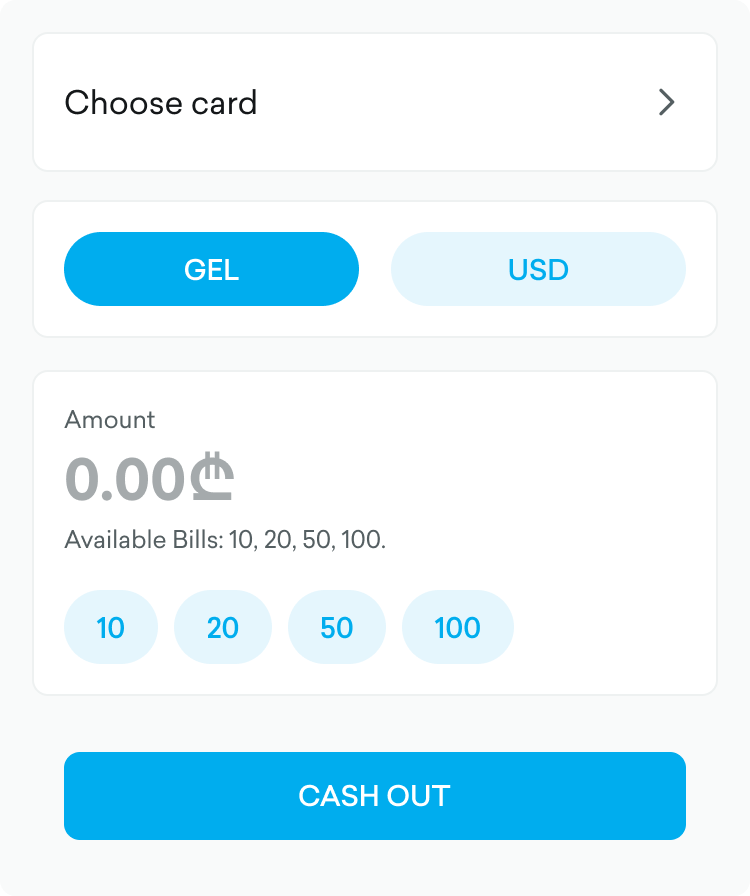

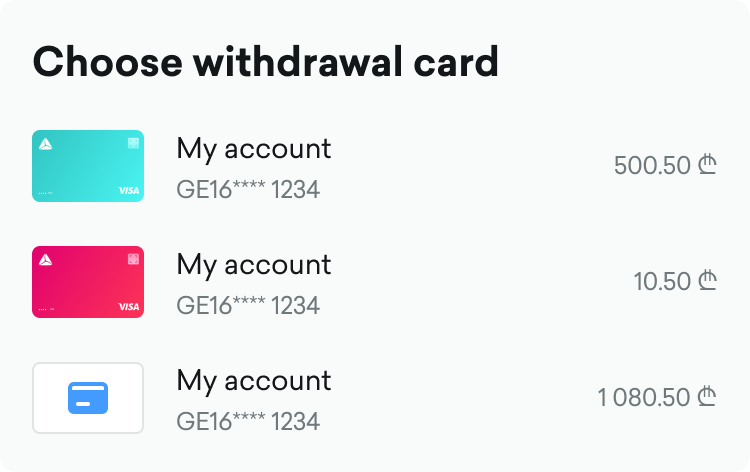

TBC Bank’s - QR Cash-Out. it’s a Mobile app feature that lets users withdraw cash from ATMs using only their phone, scanning a QR code instead of inserting a physical card.

App name

TBC

My role

Product designer

Platform

iOS / Android

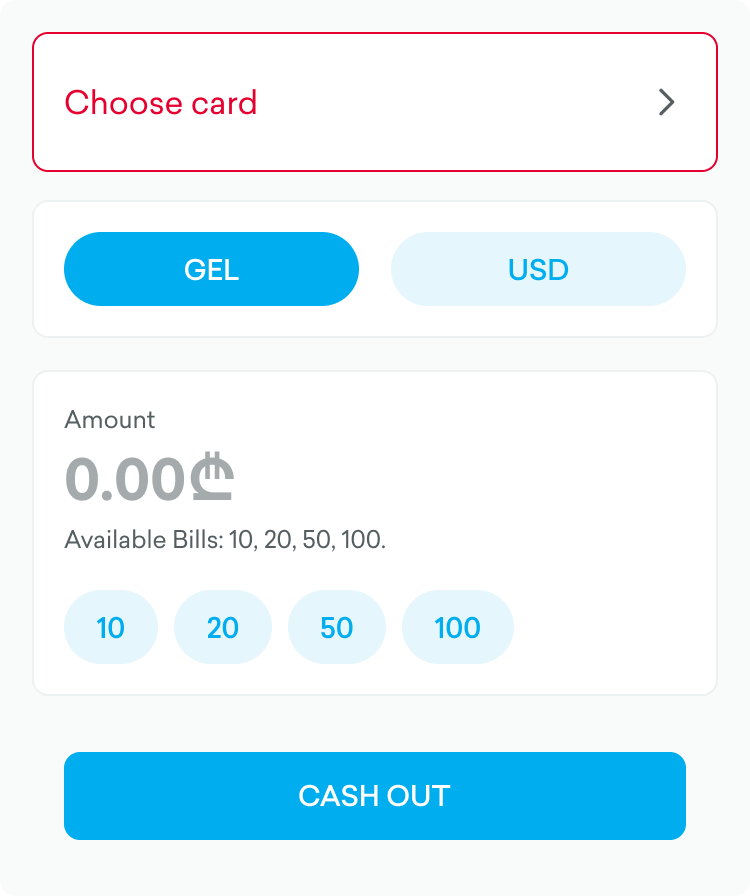

TBC’s QR Cash-Out was already live, enabling users to withdraw cash without a physical card. Yet adoption remained low—most users weren’t aware of the feature, and those who did often encountered real/digital-world friction.

My challenge was to understand why a feature designed for convenience wasn’t performing as expected, identify the barriers across both the physical and digital touchpoints, and redesign the experience to make cash-out more intuitive, visible, and usable in real conditions.

During discovery, initial UX audit revealed critical usability issues, particularly around feature visibility and user flows. However, to improve adoption and uncover deeper behavioral problems, we conducted both qualitative and quantitative research.

These findings helped us reframe QR Cash-Out not just as a digital ATM replacement, but as a real-world experience shaped by environment, context, and user habits.

Marketing Message Placeholder

Scan QR code from the App and cash-out without a card

or type

4

6

2

3

Amount

65.00

$

Available Bills: 10, 20, 50, 100.

10

20

50

100

Amount not available

We can’t make exactly $65 with our current bills

Choose Alternative

$ 60

$ 70

1

3

Thank you

Home Page